Let's mirror a $20m trader

It's rare to see one up close

Watch as we pick apart someone who is in the spotlight.

Ariel — the trader who turned $20k into 20m.

These are not income claims.

This is what he did.

I’m not his auditor.

But I don’t speak highly of very many traders.

$20k to $20m is what his position size and internet trail suggests.

That’s his story and he’s sticking with it.

You want to go back and watch all his YouTube videos and re-read his X posts from years ago?

Be my guest.

I already did that.

Kapeesh?

Ok—let’s see what he has to say.

Obviously every one of these screenshots are from his public X post which you can just read instead of wasting your time on my batshit analysis.

That image is clickable.

It’s a link to his thread.

OK—just being 100% bulletproof in giving credit where credit is due.

Onward…

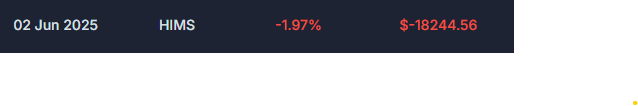

He took an $18k loss on HIMS 0.00%↑ .

On June 2nd.

Here’s the actual execution:

Pretty straightforward?

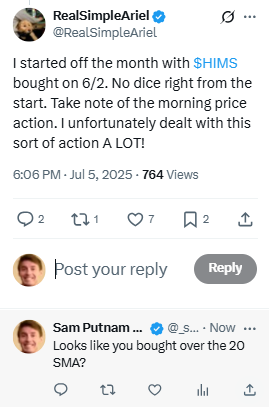

He bought the opening range break and the range did break.

To the downside.

False break out.

June 2nd was that little red day before the massive fail candle.

Here’s the intraday so you can really see where he bought, what he risked, and how big of a gap up and fail that next day was…

So he bought on the middle day there. And sold risking the open.

Or risking the day prior’s close.

Same difference.

Quick buy quick sell.

Small loss.

For him.

For an $18m account—

$18k is 0.1%.

For a $25k account it would be like you lost $25.

Normal loss.

Ok.

Let’s continue.

It’s hard to say exactly what he was thinking but that was a Monday.

So he was buying on a moon Monday.

After a green day on Friday.

Was it a buy over the 20d SMA?

The 20d simple moving average is in RED.

He might tell us— TBD…

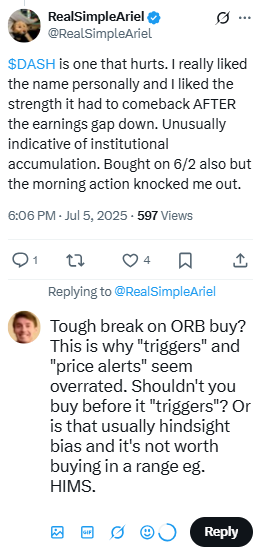

Now the next trade he took was DASH 0.00%↑.

Same day.

June 2nd.

Another buy at open and sell when the price dropped below open.

Now— we can see why he’s upset he sold…

Even though the daily candle looks good—this is the problem with buying opening range breaks.

Yes, you are buying on a “trigger”, but you are also giving yourself wider risk and more opportunity to get shaken.

Unfortunely, this is a case of the latter.

It looks like he was buying over the Wednesday high around 210.71…

Which again, is fine.

But we saw what happened in this case.

But you also can’t buy in a range—it’s bad practice…

So—

What a conundrum.

We’ll see what Ariel does with this chunk of text I hurled at him

If you missed HIMS 0.00%↑, you’re in luck.

That was a doozy to the downside.

Buying in a range was a problem there.

Small loss, though.

$10k.

Almost 0.05% of his account.

If you had a $25k account that’s a $10 loss.

Almost as if it were a test trade.

OK.

Moving on—

Let’s see what he did on Tuesday, 6/3.