Why Dumb Sounding People Who Play Poker Become Rich And Your Friend Who Sounds Way Smart is Poor AF

It’s a little something called discipline….

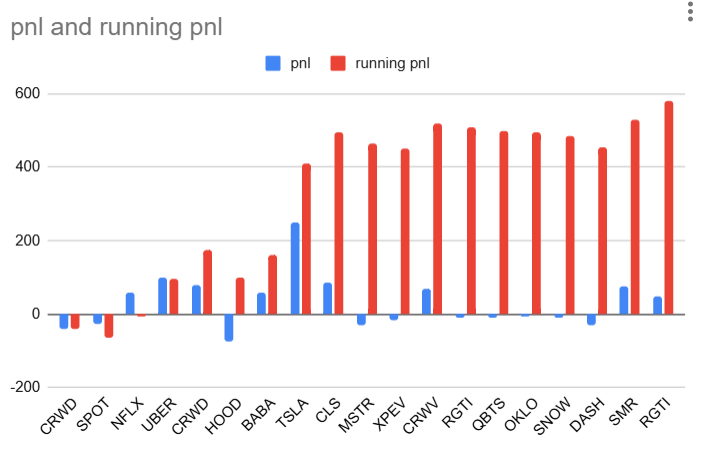

Take a look at this chart —

That’s the profit in thousands of an investor over the last 45 days…

The red is the money in his cash register.

You can see how it’s going up ~ for the most part.

The blue is how he is doing on any individual bet.

You can see how he made a mistake on HOOD 0.00%↑ but otherwise when he loses a bet he pretty much folds.

This is the way to millions.

I can say that realistically because he has made millions.

$30k to $20m…

You can’t replicate the $30k to $1m part…

Well, you can—just realize you are going to take on more risk than he did because the market is less filled with people staring at their computers during a lockdown losing their stimulus checks to smart people like him…

But if you already have $1m— this is the way.

He also shared some exact trades that you can see in detail at the thread below which I’ve linked to (link) and is public on X—

All I’ve done is written a 4000 word post analyzing them in detail and given you a running pnl of these trades based on the information he has provided the public, compared it to a poker playing dog, and contrasted it to the broader market so newer traders can see exactly how he is making so much money even or especially when the tariff macro is so nutty…

Here's his first piece of analysis from X—

$CRWD was one of the first names I noticed who put in a strong double bottom on 4/7 and it was something I was noticing amongst today's current leaders in the market. $NFLX $HOOD $PLTR $TSLA etc. They all had issues breaking much lower than the March low. I was trying to buy it as it was breaking back above the 50sma and still a touch early with my buy. Bought on April 15th and sold the next day on a break of prior day low.

You can see the exact day he bought it on this chart here -

Now a lot of these stocks are pretty dependent on what the market is doing.

Take a look at the market on April 15th.

He got in CRWD 0.00%↑ on the right side of the V but he—nor any of us knew—there would be another V…

So he got shaken out for a small loss- no big deal.

Take a look at his analysis for $SPOT.

$SPOT Bought on the same day as $CRWD with the same sort of thinking. Double bottom acting great, let's see if I can start to gain some traction on the long side. I opened it on the same day as $CRWD and got the same result. ie: everything was market correlated. I could have gotten involved a little slower in the market with one name at a time.

As he says, everything was market correlated— that’s no always the case but most of the time that’s the case.

So SPOT 0.00%↑ stopped out too.

Now you might say— if it’s usually the case that these big stocks just follow the market why not just trade the market.

And the answer is— there is no edge in just trading the market.

Even billion dollar hedge funds struggle to maintain 20% per year in the market.

And they have risk mandates where they have to have minimal drawdowns.

Do you really want to make 20% per year?

Do you think you are as smart as their masses of computers and massive power budgets to even be able to do 20% like Renaissance… etc….?

You might be… but again—-take advantage of your STRENGTHS.

You don’t have to trade the market because you don’t have to deploy hundreds of millions of dollars with every trade.

You can trade individual stocks and not move them.

AND the whole point of this strategy is that THERE IS EDGE in trading individual stocks because they DO NOT ALWAYS follow the market.

That is where you get your 10% difference in how individual stocks move versus the broader market.

If you can bet CORRECTLY on which stocks those are going to be.

And obviously on WHICH DIRECTION they are going to move.

You can be GARBAGE at predicting what the market is going to do.

As good as flipping the coin that is….

But you can be 60% right at predicting WHICH STOCKS are going to move.

And 60% right at WHICH DIRECTION they are going to move.

And when you SHORT - if you short - these big stocks… they are not going to short squeeze you to the bankruptcy courts because they are SO DAMN BIG…

We’re not talking about china scams here, we’re talking about companies with thousands of employees and billions of dollars of GAAP accounting profits audited by US accounting firms…

So with all that said— If you’re 60% at predicting WHICH STOCK.

And you’re 60% right at predicting WHICH DIRECTION.

Now you’ve got EDGE.

And you can scale that edge up by taking MORE TRADES—

And fine tuning your POKER BETTING on these trades—

Let’s show more examples to prove it.

So we saw CRWD 0.00%↑

And we saw SPOT 0.00%↑

So at this point Ariel is down about $60k.

Let’s say he is trading with $20m.

That’s actually a perfect example for a new trader—someone with a small $20k account.

Like me.

Imagine losing $60 on your $20k.

Would you be freaking out?

No.

That’s what Ariel lost.

Effectively.

On his $20m.

So you’re down $60 on a couple of longs on a bad market day.

No big deal…

Let’s see what happened next…

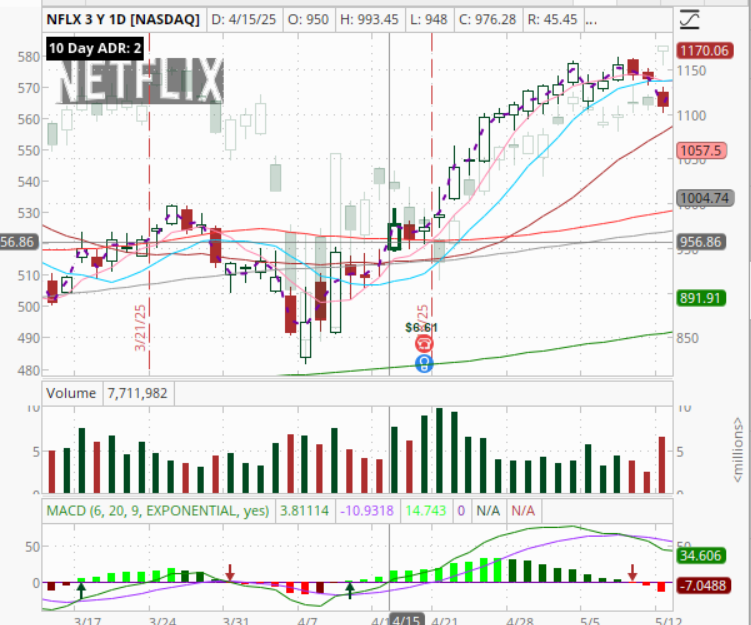

$NFLX bought on 4/22 was a very similar setup to the two mentioned above but when I came it to buy it, the market just had a nasty breadth day and $NFLX held in very well the day prior for earnings. $NFLX was already a name I was watching as early as $854 as an Undercut and rally setup. So, I knew I wanted to own this one and which I still own today!

Let’s look at what the market was doing on 4/22 first, so we can get an idea if this one is going to work just by looking at what the market did.

Oh yeah—that’s prime right side of the V territory.

That’s so right sider of the V that a hindsight trader would post he called that V.

So Ariel did or did not call the V—we don’t know.

All we know is he bought $NFLX.

So we don’t have to care if he is a macro genius.

We can look at his PNL and say—this guy is a poker pro playing the right game—STOCKS.

OK— so here’s his NFLX chart—

Pretty sick.

If you look closely and you adjust your eyes a bit to the foreigness of someone else’s charting layout you can see the SPY candles overlaid behind the NFLX candles.

So he also had earnings going for him for Netflix.

So this was a pretty sweet earnings season opportunity.

Not only was the market about to rebound.

But it was also earnings season.

He still owns it today he says but he got off some sells and that gives us our updated running pnl.

No longer -$60.

No we are at $0

We are back to a flat $20k account.

And that’s not counting the shares he is still holding in NFLX.

Whatever amount that may be.

But let’s ignore that for the time being.

What did he do next.

$PLTR opened on 4/23. After gaining some traction the day prior on $NFLX I knew to keep trying to get involved on the long side using progressive exposure. $PLTR had a subtle gap up in the morning and trying to break a flat pivot at $100. The ugly part about this one, I didn't trail the 20sma even on my small shares. I closed the final portion of my shares on the earnings gap down.

The voice of Qullamaggie haunts me right now. "Trail the 10 and the 20... trail the 10 and the 20"

Oh dear, Qullamaggie is not going to be happy with his young padawan…

It’s okay—he’s on a book tour or whatever—

So what was the market doing on 4/23?

Well, pretty much the same thing.

It was the start of a big UP move.

Here’s the PLTR buy from Ariel.

And now suddenly he’s up

$120.

Just like that.

Helps when your wins are bigger than your losses.

Pure poker pro.

Ok… so what happened next in this saga.

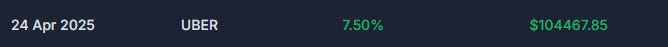

By the time I bought $UBER on 4/24 as a 50sma MAU&R. I was already working with some traction and unrealized gains. The market had given us a follow through day, and it was just a matter of finding myself in names I felt were leadership. I did the best to trail this one as long as I could. I tried to add back smaller pieces twice and it cost me some of gains but overall happy with how I handled $UBER. closed on 5/29 when we lost the 20sma

So he bought UBER on the same day.

So the market was doing the same thing.

Not helping PLTR any more than it was helping UBER.

A rising tied lifts all boats.

OK—solid move.

Now he’s up at $220.

The math is mathing.

Ok—next trade.

$CRWD on 4/24 similar to $UBER. I was already working with traction, and it was a name I knew I wanted to own. Truthfully, I did a poor job managing this one. Not only did I try adding to my trimmed and winning position, but because I added I ended up giving up some gains and then unable to sit with it because I thought it was a failed breakout on 5/21. It never closed below the 20sma and my impatience got the best of me.